Who hasn’t driven down a bumpy, pothole-filled road and wondered where their taxpayer dollars are going? In 2018 alone, highway and road repairs across the U.S. totaled a whopping $145.33 billion—but that hasn’t been enough to keep up with the nation’s ailing transportation infrastructure. It’s estimated that 1 in 5 miles of highways and major roads—along with 45,000 bridges—are in poorly maintained condition. States usually charge motorist taxes to pay for the construction and maintenance of these roads.

[TRENDING: VIDEO: Boat explosion injures 4 in Daytona Beach | Wet week on tap as strong storms expected | Win tickets to watch Artemis 1 rocket launch | Become a News 6 Insider (it’s free!)]

Recommended Videos

To determine which states depended the most on taxes for roadway maintenance projects, Jerry compiled data from local and state government finance sources, the Federal Highway Administration, and the Tax Foundation, an independent, nonprofit tax policy institute that uses figures from the U.S. Census Bureau. States that have more highway repairs needed than they have tax income to fund often turn to other additional taxes to make up the difference.

Variables like inflation and the popularity of electric cars are throwing a wrench into states’ highway funding plans. In addition, newer cars, which were once reliable sources of revenue in the past, now have better fuel economy, decreasing the amount of fuel-related taxes that states can collect. Looking ahead, many federal and state legislators are exploring a vehicle miles traveled tax, according to the Tax Foundation. This alternative approach is based on the number of miles a motor vehicle user travels instead of how much they spend on fuel. Though it would bring in more revenue, it also raises alarm bells regarding taxpayers’ privacy.

The four states that managed to raise 100% for their road-related costs through charges and tolls, licensing fees, and motor fuel taxes are California, Tennessee, Montana, and Indiana. Not surprisingly, California’s expenditures dwarf the others, with the Golden State spending $12 billion on roadway maintenance. Tennessee and Indiana spent about $1.6 billion for their shares of highway expenditures and Montana came in at less than $500 million.

Among all four states, the largest amount of taxpayer money came in the form of motor fuel tax revenues. Indiana sourced 78% of its infrastructure revenue from gas taxes, with Tennessee (67%), Montana (57%), and California (53%) following behind. The other funding sources include licensing revenue and tolls.

On the other side of the spectrum are the states where taxpayer money accounted for only a small share of their highway spending. These include Alaska, where only 17% of highway spending was sourced from state infrastructure revenue, and North Dakota, where it was only 29%. To make up for their shortfall, both of these states turn to revenue from severance taxes, which are levied when natural resources like oil and natural gas are extracted from the state.

When it comes to size, Wyoming taxpayers, who live in the least populated state, contributed 58%, or $409 million, to their state infrastructure expenses. By comparison, the two most populous states after California are New York and Texas. New Yorkers contributed 60%, or $13 billion, to the total cost of maintaining their roadway while Texans kicked in 74%, or $11 billion. All of these states must turn to other sources for funding, such as revenue collected from other levies or the federal government.

Below are the state infrastructure revenue and highway spending numbers for every state and Washington, D.C. Using 2018 figures from a Tax Foundation study, the following data does not include contributions to the individual states and Washington D.C. from the federal government, only those portions for which the states themselves are responsible. Those states that raised more than 100% of their highway- and road-related costs were ranked according to the percentage that exceeded the full portion raised. Any ties in the rankings are the result of rounding the figures.

f11photo // Shutterstock

#51. Washington D.C.

- District's highway spending in 2018: $433.2 Million

- District infrastructure tax revenues: $66.5 Million

- Amount of district's highway spending funded by motorist taxes: 15%

Jay Juno // Shutterstock

#50. Alaska

- State's highway spending in 2018: $1.05 Billion

- State infrastructure tax revenues: $180.8 Million

- Amount of state's highway spending funded by motorist taxes: 17%

Guy William // Shutterstock

#49. North Dakota

- State's highway spending in 2018: $1.15 Billion

- State infrastructure tax revenues: $335.8 Million

- Amount of state's highway spending funded by motorist taxes: 29%

SNEHIT PHOTO // Shutterstock

#48. Vermont

- State's highway spending in 2018: $452.6 Million

- State infrastructure tax revenues: $158.2 Million

- Amount of state's highway spending funded by motorist taxes: 35%

TLF Images // Shutterstock

#47. Utah

- State's highway spending in 2018: $1.67 Billion

- State infrastructure tax revenues: $736.7 Million

- Amount of state's highway spending funded by motorist taxes: 44%

Kristi Blokhin // Shutterstock

#46. Arkansas

- State's highway spending in 2018: $1.48 Billion

- State infrastructure tax revenues: $665.8 Million

- Amount of state's highway spending funded by motorist taxes: 45%

Canva

#45. Wisconsin

- State's highway spending in 2018: $3.94 Billion

- State infrastructure tax revenues: $1.78 Billion

- Amount of state's highway spending funded by motorist taxes: 45%

barbsimages // Shutterstock

#44. Connecticut

- State's highway spending in 2018: $1.62 Billion

- State infrastructure tax revenues: $734.9 Million

- Amount of state's highway spending funded by motorist taxes: 45%

nsiliya // Shutterstock

#43. Rhode Island

- State's highway spending in 2018: $316.4 Million

- State infrastructure tax revenues: $147.3 Million

- Amount of state's highway spending funded by motorist taxes: 47%

Sandra Foyt // Shutterstock

#42. Nebraska

- State's highway spending in 2018: $1.32 Billion

- State infrastructure tax revenues: $618.3 Million

- Amount of state's highway spending funded by motorist taxes: 47%

Mark Herreid // Shutterstock

#41. Minnesota

- State's highway spending in 2018: $4.15 Billion

- State infrastructure tax revenues: $1.96 Billion

- Amount of state's highway spending funded by motorist taxes: 47%

Paul Brady Photography // Shutterstock

#40. South Dakota

- State's highway spending in 2018: $666.3 Million

- State infrastructure tax revenues: $315.5 Million

- Amount of state's highway spending funded by motorist taxes: 47%

SunflowerMomma // Shutterstock

#39. Alabama

- State's highway spending in 2018: $2.10 Billion

- State infrastructure tax revenues: $1.01 Billion

- Amount of state's highway spending funded by motorist taxes: 48%

TFoxFoto // Shutterstock

#38. Nevada

- State's highway spending in 2018: $1.72 Billion

- State infrastructure tax revenues: $836.0 Million

- Amount of state's highway spending funded by motorist taxes: 49%

Krasula // Shutterstock

#37. Mississippi

- State's highway spending in 2018: $1.23 Billion

- State infrastructure tax revenues: $623.3 Million

- Amount of state's highway spending funded by motorist taxes: 51%

Trong Nguyen // Shutterstock

#36. Louisiana

- State's highway spending in 2018: $1.40 Billion

- State infrastructure tax revenues: $768.6 Million

- Amount of state's highway spending funded by motorist taxes: 55%

FTiare // Shutterstock

#35. Iowa

- State's highway spending in 2018: $2.41 Billion

- State infrastructure tax revenues: $1.36 Billion

- Amount of state's highway spending funded by motorist taxes: 56%

haveseen // Shutterstock

#34. Wyoming

- State's highway spending in 2018: $409.8 Million

- State infrastructure tax revenues: $238.3 Million

- Amount of state's highway spending funded by motorist taxes: 58%

Tim Roberts Photography // Shutterstock

#33. Arizona

- State's highway spending in 2018: $1.90 Billion

- State infrastructure tax revenues: $1.12 Billion

- Amount of state's highway spending funded by motorist taxes: 59%

Sean Pavone // Shutterstock

#32. New York

- State's highway spending in 2018: $13.03 Billion

- State infrastructure tax revenues: $7.84 Billion

- Amount of state's highway spending funded by motorist taxes: 60%

LisaCarter // Shutterstock

#31. Virginia

- State's highway spending in 2018: $4.48 Billion

- State infrastructure tax revenues: $2.76 Billion

- Amount of state's highway spending funded by motorist taxes: 61%

Alexey Stiop // Shutterstock

#30. Kentucky

- State's highway spending in 2018: $1.57 Billion

- State infrastructure tax revenues: $994.1 Million

- Amount of state's highway spending funded by motorist taxes: 63%

Vicki L. Miller // Shutterstock

#29. Colorado

- State's highway spending in 2018: $2.77 Billion

- State infrastructure tax revenues: $1.78 Billion

- Amount of state's highway spending funded by motorist taxes: 64%

JSvideos // Shutterstock

#28. North Carolina

- State's highway spending in 2018: $4.64 Billion

- State infrastructure tax revenues: $2.99 Billion

- Amount of state's highway spending funded by motorist taxes: 65%

inarts // Shutterstock

#27. Maine

- State's highway spending in 2018: $785.5 Million

- State infrastructure tax revenues: $513.0 Million

- Amount of state's highway spending funded by motorist taxes: 65%

amadeustx // Shutterstock

#26. Kansas

- State's highway spending in 2018: $1.30 Billion

- State infrastructure tax revenues: $852.3 Million

- Amount of state's highway spending funded by motorist taxes: 66%

Christian Hinkle // Shutterstock

#25. Pennsylvania

- State's highway spending in 2018: $9.08 Billion

- State infrastructure tax revenues: $6.00 Billion

- Amount of state's highway spending funded by motorist taxes: 66%

Medard L Lefevre // Shutterstock

#24. West Virginia

- State's highway spending in 2018: $846.4 Million

- State infrastructure tax revenues: $559.9 Million

- Amount of state's highway spending funded by motorist taxes: 66%

Real Window Creative // Shutterstock

#23. Missouri

- State's highway spending in 2018: $1.56 Billion

- State infrastructure tax revenues: $1.06 Billion

- Amount of state's highway spending funded by motorist taxes: 68%

Brian Kapp // Shutterstock

#22. Ohio

- State's highway spending in 2018: $4.61 Billion

- State infrastructure tax revenues: $3.16 Billion

- Amount of state's highway spending funded by motorist taxes: 69%

Wangkun Jia // Shutterstock

#21. New Hampshire

- State's highway spending in 2018: $586.8 Million

- State infrastructure tax revenues: $419.1 Million

- Amount of state's highway spending funded by motorist taxes: 71%

FiledIMAGE // Shutterstock

#20. Illinois

- State's highway spending in 2018: $6.35 Billion

- State infrastructure tax revenues: $4.59 Billion

- Amount of state's highway spending funded by motorist taxes: 72%

Kristi Blokhin // Shutterstock

#19. South Carolina

- State's highway spending in 2018: $1.64 Billion

- State infrastructure tax revenues: $1.21 Billion

- Amount of state's highway spending funded by motorist taxes: 74%

Regan Bender // Shutterstock

#18. Texas

- State's highway spending in 2018: $11.54 Billion

- State infrastructure tax revenues: $8.59 Billion

- Amount of state's highway spending funded by motorist taxes: 74%

Brett Barnhill // Shutterstock

#17. Georgia

- State's highway spending in 2018: $3.04 Billion

- State infrastructure tax revenues: $2.29 Billion

- Amount of state's highway spending funded by motorist taxes: 75%

Suraju Kehinde // Shutterstock

#16. Maryland

- State's highway spending in 2018: $3.07 Billion

- State infrastructure tax revenues: $2.35 Billion

- Amount of state's highway spending funded by motorist taxes: 76%

Gordon Montgomery // Shutterstock

#15. Oregon

- State's highway spending in 2018: $1.58 Billion

- State infrastructure tax revenues: $1.23 Billion

- Amount of state's highway spending funded by motorist taxes: 78%

O.Malikoff // Shutterstock

#14. Florida

- State's highway spending in 2018: $9.15 Billion

- State infrastructure tax revenues: $7.26 Billion

- Amount of state's highway spending funded by motorist taxes: 79%

View Apart // Shutterstock

#13. Massachusetts

- State's highway spending in 2018: $2.82 Billion

- State infrastructure tax revenues: $2.24 Billion

- Amount of state's highway spending funded by motorist taxes: 79%

Melanie Hobson // Shutterstock

#12. New Mexico

- State's highway spending in 2018: $572.0 Million

- State infrastructure tax revenues: $460.4 Million

- Amount of state's highway spending funded by motorist taxes: 80%

Real Window Creative // Shutterstock

#11. Michigan

- State's highway spending in 2018: $3.56 Billion

- State infrastructure tax revenues: $2.91 Billion

- Amount of state's highway spending funded by motorist taxes: 82%

Nick Fox // Shutterstock

#10. Oklahoma

- State's highway spending in 2018: $1.93 Billion

- State infrastructure tax revenues: $1.59 Billion

- Amount of state's highway spending funded by motorist taxes: 82%

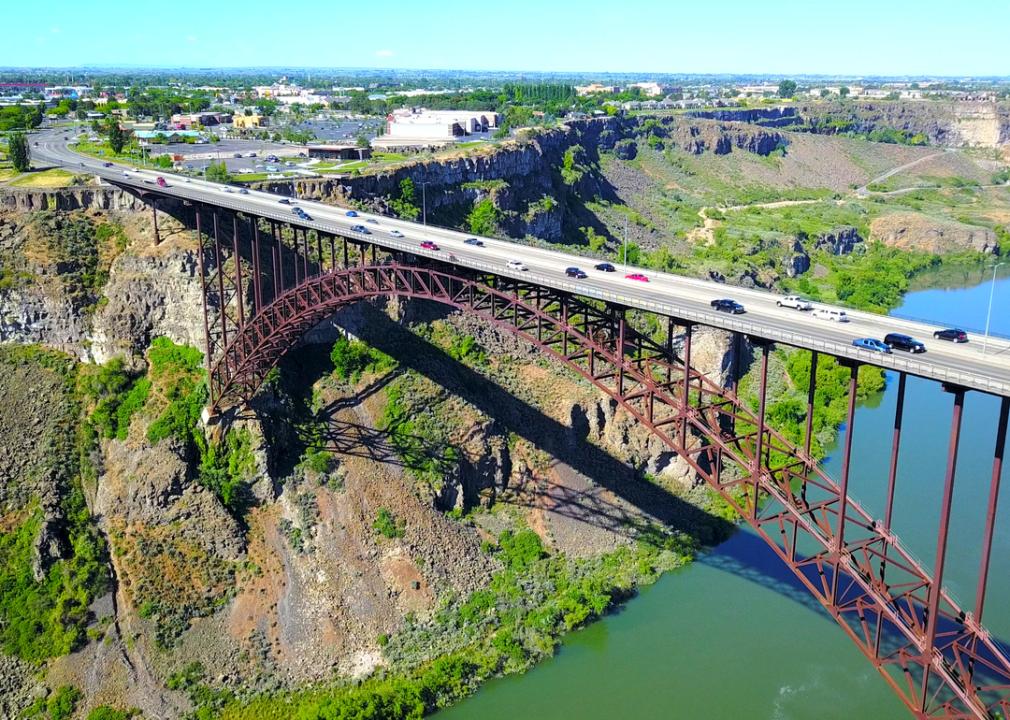

Inbound Horizons // Shutterstock

#9. Idaho

- State's highway spending in 2018: $735.0 Million

- State infrastructure tax revenues: $611.8 Million

- Amount of state's highway spending funded by motorist taxes: 83%

Nadia Borisevich // Shutterstock

#8. Hawaii

- State's highway spending in 2018: $700.2 Million

- State infrastructure tax revenues: $588.6 Million

- Amount of state's highway spending funded by motorist taxes: 84%

FotosForTheFuture // Shutterstock

#7. New Jersey

- State's highway spending in 2018: $3.98 Billion

- State infrastructure tax revenues: $3.38 Billion

- Amount of state's highway spending funded by motorist taxes: 85%

Khairil Azhar Junos // Shutterstock

#6. Delaware

- State's highway spending in 2018: $583.6 Million

- State infrastructure tax revenues: $515.0 Million

- Amount of state's highway spending funded by motorist taxes: 88%

Checubus // Shutterstock

#5. Washington

- State's highway spending in 2018: $3.72 Billion

- State infrastructure tax revenues: $3.53 Billion

- Amount of state's highway spending funded by motorist taxes: 95%

Mark Schwettmann // Shutterstock

#4. California

- State's highway spending in 2018: $12.03 Billion

- State infrastructure tax revenues: $11.99 Billion

- Amount of state's highway spending funded by motorist taxes: 100%

Valerie Ann Ayres // Shutterstock

#3. Tennessee

- State's highway spending in 2018: $1.60 Billion

- State infrastructure tax revenues: $1.61 Billion

- Amount of state's highway spending funded by motorist taxes: 100%

Michael Gordon // Shutterstock

#2. Montana

- State's highway spending in 2018: $433.6 Million

- State infrastructure tax revenues: $446.7 Million

- Amount of state's highway spending funded by motorist taxes: 100%

Shadowspeeder // Shutterstock

#1. Indiana

- State's highway spending in 2018: $1.61 Billion

- State infrastructure tax revenues: $1.81 Billion

- Amount of state's highway spending funded by motorist taxes: 100%

This story originally appeared on Jerry and was produced and distributed in partnership with Stacker Studio.